| The stock market experienced solid gains last week, concluding the trading week on a positive note, thanks to robust corporate reports and favorable inflation news; this propelled the S&P 500 Index to achieve a new record high at the end of the week. |

| S&P Tops 5,000 |

| At the start of last week's trading, stocks faced downward pressure due to comments by Fed Chair Powell over the weekend, signaling that the Federal Reserve had no immediate plans to initiate interest rate cuts. Consequently, the yield on the two-year U.S. Treasury note, highly influenced by monetary policy, increased to its highest level in two months. By the end of trading on Monday, stocks had regained a significant portion of their previous losses. Influencing this market rally were positive corporate earnings reports. This trend continued throughout the week, contributing to the overall market momentum. By Friday, 67% of the companies listed in the S&P 500 had released their Q4 results, and an impressive 77% of those companies exceeded earnings expectations. Investors expressed enthusiasm on Friday after a report indicating that December's inflation was lower than initially anticipated. This positive news revitalized buying activity, resulting in the S&P 500 surpassing 5,000 for the first time. |

|

|

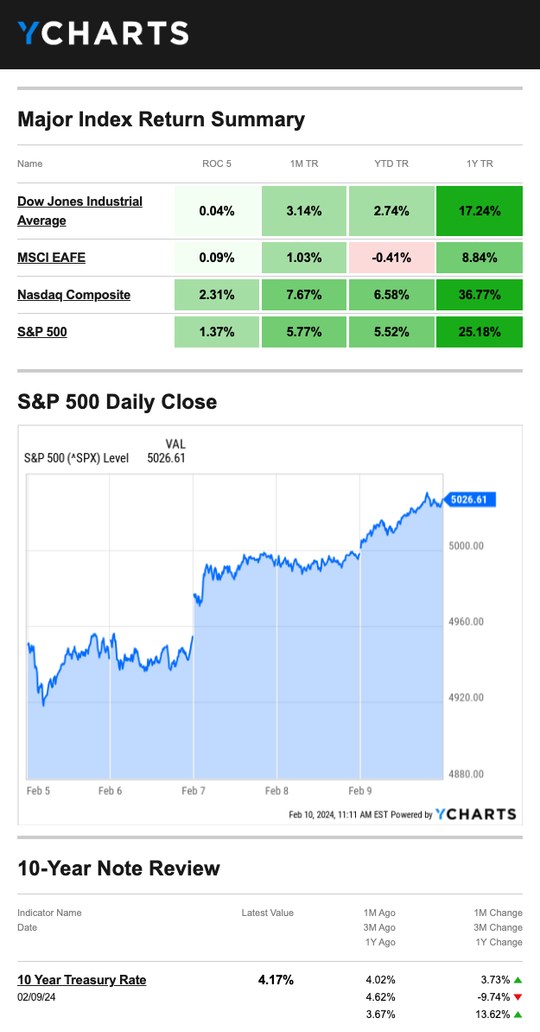

| Source: YCharts.com, February 10, 2024. Weekly performance is measured from Monday, February 5, to Friday, February 9. ROC 5 = the rate of change in the index for the previous 5 trading days. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points. |

| Economic Strength The strength of the U.S. economy has come into the spotlight. An analysis conducted by The Wall Street Journal recently proposed that the economy's resilience could be attributed, at least in part, to the productivity driven by the technology sector. What might rein in that productivity? One possible influence could be the increase in oil prices witnessed last week. Additionally, shipping companies have been imposing surcharges for several months to mitigate recent conflict, and these charges may contribute to global inflation this year, potentially dampening investor enthusiasm. |

This Week: Key Economic Data Tuesday: Consumer Price Index (CPI). Wednesday: EIA Petroleum Report. Thursday: Industrial Production. Retail Sales. Jobless Claims. Friday: Housing Starts. Producer Price Index (PPI). Consumer Sentiment. Source: Investors Business Daily - Econoday economic calendar; February 8, 2024 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. |

This Week: Companies Reporting Earnings Monday: Arista Networks, Inc. (ANET), Waste Management, Inc. (WM) Tuesday: The CocaCola Company (KO), Shopify Inc. (SHOP), AirBnB, Inc. (ABNB), Moody’s Corporation (MCO) Wednesday: Cisco Systems, Inc. (CSCO), Sony Corporation (SONY), Kraft Heinz Company (KHC) Thursday: Applied Materials, Inc. (AMAT), Deere & Company (DE) Source: Zacks, February 8, 2024 Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice. |

|

Are You Prepared for a Natural Disaster? Natural disasters, such as hurricanes, earthquakes, or fires, can happen anytime, so preparing before disaster strikes is essential. Here are a few tips to help you prepare in case anything happens: |

|

| These tips may help you have everything you need ready in the case of a natural disaster or other emergency. *This information is not intended to substitute for specific individualized tax advice. I suggest you discuss your specific tax issues with a qualified tax professional.Tip adapted from IRS.gov7 |

Footnotes and Sources 1. The Wall Street Journal,February 4, 2024 2. FactSet.com, February 9, 2024 3. CNBC.com, February 9, 2024 4. WSJ.com, February 8, 2024 5. CNBC, February 9, 2024 6. IRS.gov, March 8, 2023 7. Fastcompany.com, October 9, 2023 |

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2024 FMG Suite. |

| Dave Fischesser dave@fischfinancial.com 630-346-3302 Fisch Financial http://www.fischfinancial.com/ |